In Your Own Words Describe the Risk Return Trade Off

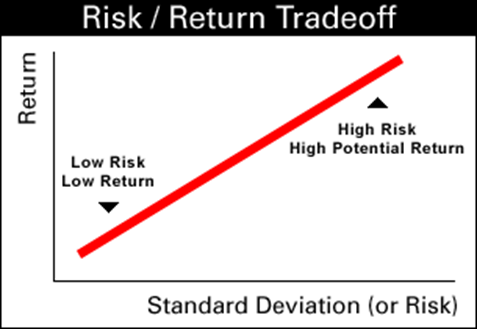

The risk-return trade-off states that the level of return to be earned from an investment should increase as the level of risk goes up. Most of the time this trade-off is between risk and potential return.

/risk-439e02ef8cb24649b62178309b097954.jpg)

Risk Return Tradeoff Definition

Conversely this means that investors will be less likely to pay a.

/TheEfficientFrontier-44cc1fd8b2444de68cc7e2ea92c1c032.png)

. The Riskreward trade-off is the key that prospective return increases with an increase in risk. Important things to know related to risk return tradeoff Measuring Singular Risk in Context. Brief Explanation of Risk reward trade-off Low stages of doubt or risk are associated with low prospective profits whereas great stages of doubt or risk.

The risk return trade off is a financial concept that suggests that the higher the risk the higher the possible profit. The risk-return trade-off is the concept that the level of return to be earned from an investment should. This trade off which an investor faces between risk and return while considering investment decisions is called the risk return trade off.

High levels of uncertainty high risk are associated with high potential returns. When considering investment choices investors evaluate the risk return trade. Note Risk return trade-off is applicable to all finance activities.

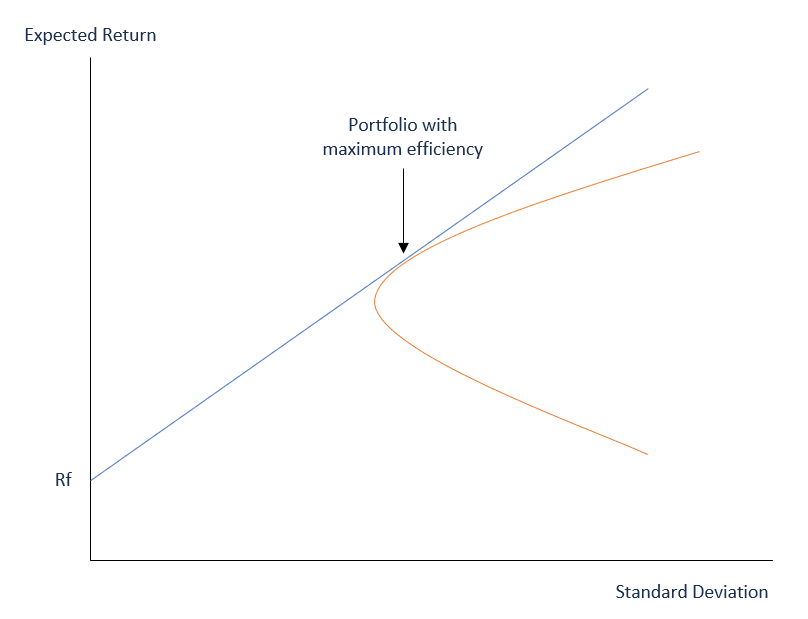

Likewise the less risky an investment is the lower the returns or rewards are likely to be. For analysis of choice of a portfolio of assets by individuals or firms we require to explain the concept of risk-return trade-off function which are represented by indifference curves between degree of risk and rate of return from investment. Risk return tradeoff is an investing term that describes the relationship between the risk an investor takes and the level of returns he realizes.

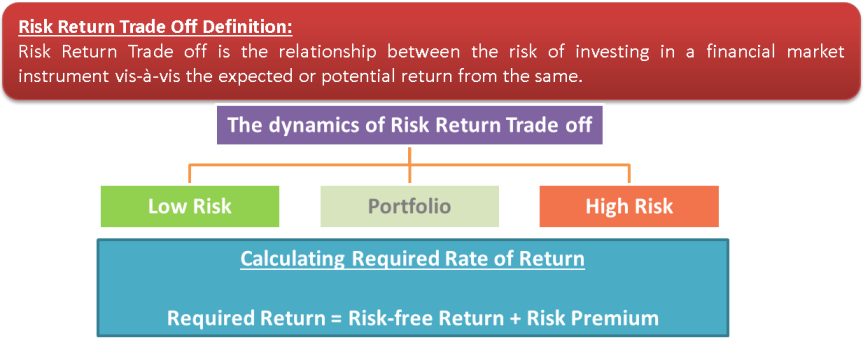

Risk-Return Tradeoff is the relationship between the risk of investing in a financial market instrument vis-à-vis the expected or potential return from the same. Special Considerations in Risk-Return Trade-Off. When an investor is willing to invest the amount in high-risk investments heshe can apply the risk-return tradeoff within the portfolios context as a whole or on a singular basis.

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. High price for investments that have a low risk level such as high-grade corporate or. How do income growth and liquidity affect the choice of an investmentAction Application Using Internet research and discussion with other people determine if you prefer less risk and conservative investments or more risk and.

Higher risk entails more returns while lower risks offer fewer returns. Your risk here is the chance that your units will be worth less than Rs 14050 downside risk in 3 years from today or the chance that your units will be worth more Yes. It is more of the mentality of an investor than an actual principle as high-risk investments could be illusionary and could result in nothing but loss.

Describe risk-return trade-off and why it is important to financial managers. Risk-return trade-off affects every persons life not just financial managers. Return Risk Free rate Risk Premium.

But this mentality among everyone that high risk equates to high returns is called return risk trade-off. Discuss how you have reached a decision in your life using risk-return. Risk can be divided in two ways.

The capital is secure and the market price does not fluctuate. This principle is called return risk trade-off. Definition of Risk Return Trade Off.

Rs 14050 in 3 years time. Low levels of uncertainty low risk are associated with low potential returns. Solutions for Chapter 13 Problem 2PQ.

The riskreturn tradeoff is the balance between the desire for the lowest possible risk. What are the five components of the risk factor3. Risk-return trade-off in mutual funds.

But before we can understand the relationship between risk and reward we need to solidify our understanding of risk. This can be understood well by following the working principles of mutual funds. This tradeoff which an investor faces between risk and return while considering investment decisions is called the risk-return trade-off.

Even this is called a risk. Understanding this trade-off at a conceptual level will go a long way in helping you to select the right investments or strategies on your path to retirement. This trade off which an investor faces between risk and return while considering investment decisions is called the risk return trade off.

Different investors will have different tolerances for the level. Risk and the Budget Line. In your own words describe the riskreturn trade-off2.

Since R m R f and σR m are positive constants the slope of the line R m R f σR m is also a positive constant as is the intercept R f. Equation 79 is a budget line because it describes the trade-off between risk σ Rp and expected return R p. Historically mutual fund units have yielded 12 annual return and hence you expect your investment to grow to approx.

Systematic risk - the risk in the market that. Mutual funds returns vary considerably between small-cap funds mid-cap funds large-cap funds hybrid funds debt funds etc and so. The theory of choice under risk and uncertainty is also applicable in case of an investor who has to invest his.

Risk-return tradeoff states that risk is positively related to the return. Let us note that it is the equation of a straight line. As risk increases so does the potential for higher returns.

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. In fact with interest rates at historical lows the total return on some low or no-risk investments is negative after taxes and inflation. For instance if a person resigns from a manufacturing company in Utah to work in a mining company in Nevada and then days before departure the company.

Risk return tradeoff is an investing term that describes the relationship between the risk an investor takes and the level of returns he realizes. What at first appears to be a safe investment actually contains the real risk of. A GIC is one example of a risk-off investment.

While making investment decisions one important aspect to consider is what one is getting in return for the investment being made. Investors must analyze a number of aspects when calculating an acceptable risk return trade off such as general risk tolerance the ability to recover lost capital and much more. The trade-off for zero risk is low return.

Conversely this means that investors will be less likely to pay a high price for investments that have a low risk level such as high-grade corporate or government bonds. Increase as the level of risk increases. Conflicts of interest and moral hazard issues that arise when a principal hires an agent to perform specific duties that.

The simple formula between risk and return is given by. The two move in tandem.

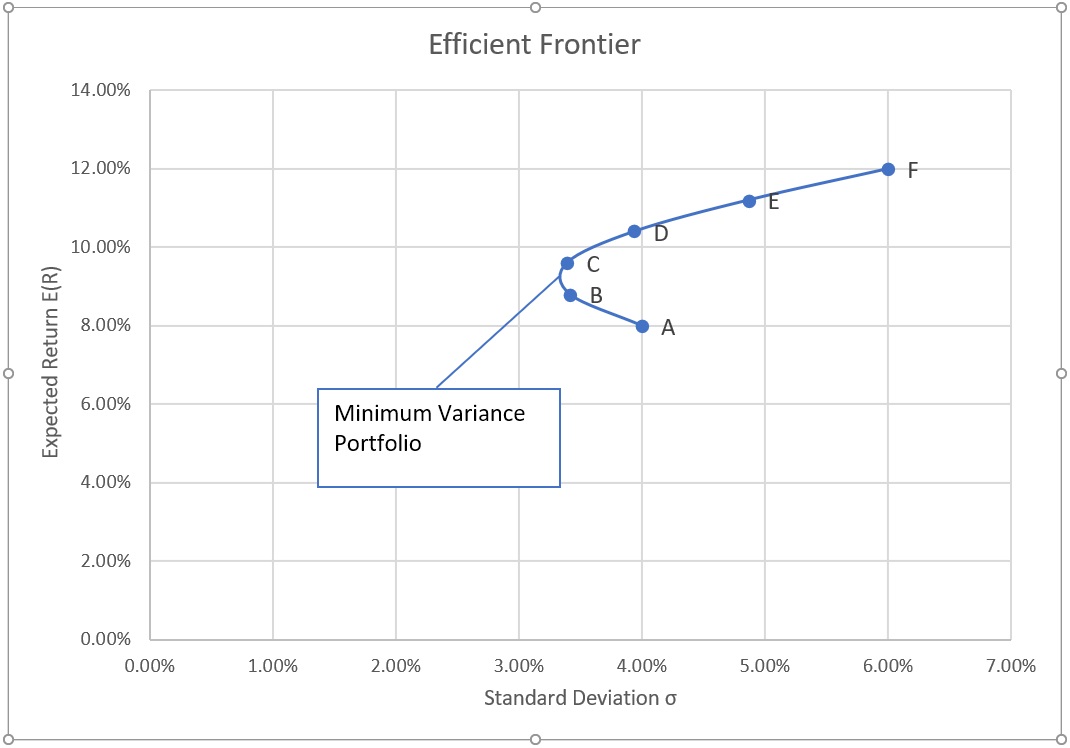

Efficient Frontier Graph Example

(77).jpg)

Concept Of Risk And Return Quiz Proprofs Quiz

Modern Portfolio Theory Efficient And Optimal Portfolios The Efficient Frontier Utility Scores And Portfolio Betas

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

Does The Capital Asset Pricing Model Work

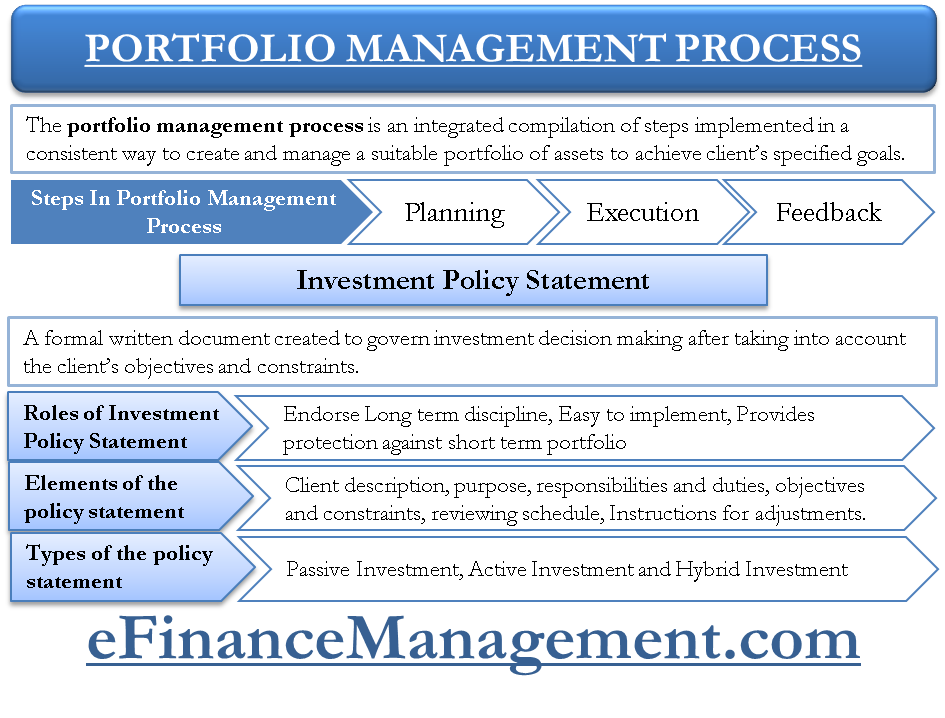

Definition Of Portfolio Management Process

Risk Return Tradeoff Definition

Risk Return Trade Off The Dynamics Of Risk Return Trade Off

Risk And Return Financial Edge

The Risk And Return Relationship Part 2 Capm Acca Qualification Students Acca Global

Risk Return Trade Off The Dynamics Of Risk Return Trade Off

The Risk And Return Relationship Part 2 Capm Acca Qualification Students Acca Global

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Comments

Post a Comment